Early Days

As a young kid riding a Honda Big Red 3-wheeler around the pasture as fast as I could possibly go, I never imagined that I would be standing on the top step of the podium at the 24 Hours of Le Mans under an American flag listening to the Star Spangled Banner in front of 300,000 fans. And, when I was in a drug treatment center for the second time in High School, I could never have imagined that I would be the largest privately held car dealership group in the State of Texas. It is crazy to think about where life takes us, but let me start where it all began.

KEATING’S PATH TO TEXAS A&M

If I were to choose musical lyrics to summarize my life, I could easily go with, “So many times it happens too fast. You change your passion for glory. Don’t lose your grip on the dreams of the past. You must fight just to keep them alive. It’s the eye of the tiger. It’s the thrill of the fight. Rising up to the challenge of our rival.” You might recognize this from “Eye of the Tiger”, by Survivor which was made famous in the movie, Rocky III. I have felt like Rocky at times, both when he is beaten to a pulp and when he raises his arms in victory. I am not afraid to take a risk. I crave competition, love a challenge, and enjoy adrenaline. At times, those traits have helped me to be quite successful in building the Keating Auto Group and during my career as a race car driver. At other times in my life, however, those traits have led me to make some poor decisions. I went through drug and alcohol rehabilitation twice when I was at Tomball High School in the late 1980s, once as a sophomore and once again as a junior. I didn’t have much luck staying sober in Tomball, so I moved to Oklahoma City—where I finished treatment—leased an apartment and served as my own legal guardian during my senior year in high school.

In hindsight, this independence and responsibility turned out to be a good thing for me. Overcoming drug and alcohol addiction certainly wasn’t easy, but it was worth it. “Character cannot be developed in ease and quiet. Only through experience of trial and suffering can the soul be strengthened, ambition inspired and success achieved.” This quote by Helen Keller rings true in my life, even though each individual’s trials are unique. Being on my own forced me to grow up quickly.

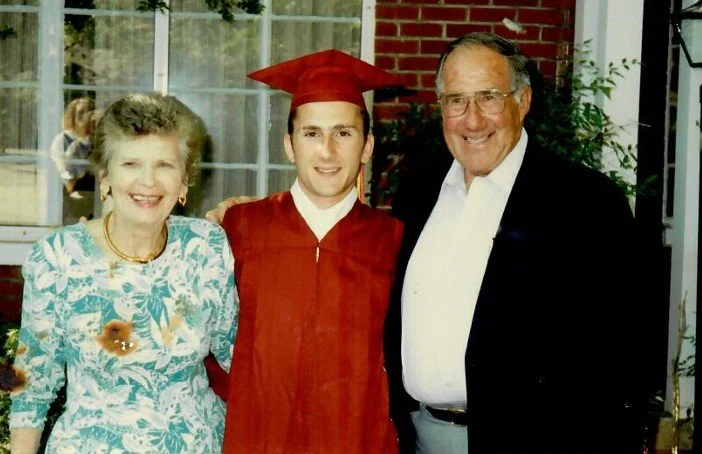

The saving grace for my time in OKC, was a great group of friends who were supportive of me and my quest to stay clean. I am proud to say that I haven’t had an alcoholic beverage or a non-prescribed drug since November 18, 1988, which was 18 months before I graduated from high school. My parents were still back in Tomball, so unfortunately, I didn’t have a mom or dad right there reminding me regularly that it was time to apply to colleges. So, as I neared my high school graduation in the spring of 1990, I began scrambling to make things happen.

I located a place where I could take an entrance exam as soon as possible, and I scored a 26 on the ACT, which is roughly the equivalent of a 1,240 on the SAT. I

applied to both Texas A&M and Texas, and I was informed that I needed at least a 27 on the ACT to be admitted to Texas. That was not the case at Texas A&M. I didn’t have time to take another test, so I decided I would attend classes in Aggieland, although I certainly didn’t look like the typical Aggie in 1990. I hadlong hair that reached to the middle of my back, and I smoked a pack of cigarettes every day.

Texas A&M

One of the best things I did right away at A&M was to attend Fish Camp. I loved that experience, and I fell in love with A&M during my time at Lakeview Methodist Conference Center in Palestine, Texas. Following Fish Camp, I began classes in the fall of 1990, where the starting quarterback for the Aggies just so happened to be Lance Pavlas, who had guided Tomball to a 28-2 record and two straight Class 4A title games. Watching Lance play at Kyle Field was like having a little piece of my hometown in Aggieland.

For me, college life as a freshman was no big deal. Many of the freshmen students had never been out on their own and away from their parents for an extended period. Some of them struggled to be successful in school because it was their first chance to be independent. It was also their first opportunity to party as often as they liked, regardless of the next day’s class schedule. Many of my classmates at A&M were in that stage of life. I was well beyond that, and I was focused on doing well in school.

In the classroom setting, I never did well at reading a chapter and answering questions about the chapter. But give me a problem to solve, and I was pretty good at finding a solution. That’s why I majored in industrial engineering, and I loved everything about the program. I was a much different person than I had been in high school, and I was much different than many of my classmates. Texas A&M has always been a conservative school, but it was definitely more conservative in the early 1990s than it is now. I finally tired of the way my fellow students looked at me when I walked out of class and lit up a cigarette on the campus sidewalks.

So in my sophomore year, I quit smoking and cut my hair to be a little less unusual in Aggieland.

I also decided I would become involved with student government. Back then, we had a student body president and six different vice presidents. I served as the vice president of student activities, and I devoted plenty of time in that role. I learned that being involved with groups on campus heightened the overall college experience because you met so many different people. I met my future wife, Kathleen, at A&M, and when we first met, I was still a motorcycle-driving, long-haired guy whose appearance was wilder than my actual lifestyle. Kathleen and I started dating our junior year. The following year as seniors, I was the president of the Institute of Industrial Engineers and Kathleen was the vice president. We clicked socially and intellectually, and I knew fairly early in my courtship of her that she was the one.

During the summer between my junior and senior year, I earned an internship working for an insurance company that serviced auto dealerships. I grew up in a family of car dealers, and I once thought I wanted nothing to do with the “family business.” My grandfather was a Ford dealer, he had five children, and four of them became Ford dealers. My father, Tom, was the Ford dealer in Tomball, and at 11 years old, I started working as a porter at my father’s dealership. So, all I knew about the car business involved parking cars in a straight line, washing cars and picking up trash. Based on those experiences, I hated the car business and I wanted nothing to do with it. Then I landed this internship with Service Group out of Austin. I attended the training classes, learned about numerous different positions in the car business and traveled with the trainers from Service Group, spending one week at a dealership and the next week at a different one.

For the most part, I was just a fly on the wall, as I was the assistant to the trainer.

However, it was during that time when I fell in love with the car business. I was and am extremely competitive and competition feeds my soul. From growing up around the business, I knew the car business to be an incredibly competitive environment. Suddenly, all my competitive juices were flowing as I learned the behind-the-scenes workings of the industry.

For the first time, I could also see myself being quite successful. While being a fly on the wall, I listened to the dealers and saw how they ran their business, and I thought to myself, “Wow, these guys are terrible.” I realize now that I was a know-at-all young kid with a ton of ambition, but I thought, “If this is the competition, I think I can run circles around these guys.” My other thought was that, even though the guys I watched were not great, they were all making a lot of money. It was during that summer that I decided this was the business for me!

Meanwhile, Kathleen was on the five-year plan to graduate because she had switched to industrial engineering after initially starting down a different path. I didn’t want to do a long-distance relationship, so I decided to begin pursuing a master’s degree in accounting. I had no plans of sticking around long enough to actually earn my master’s, but I figured that one year of the master’s accounting program would make me a better businessman and a better car dealer. Ultimately, I think it did just that.

Kathleen and I both graduated on May 13, 1995, and we were married exactly one week later at my parents’ home in Tomball on May 20, 1995. I told Kathleen to find a job anywhere in the country, because wherever she went, I could find a job in the car business. The highest paying job I knew of when I graduated went to a friend of ours, who landed a consulting role with McKinsey & Company that paid $40,000 a year. To most graduates at the time, that seemed like a fortune. In order to earn that income, our friend was traveling frequently, living out of a hotel room and working 80 hours a week. No matter how hard he worked or how successful he made his clients, he was still going to earn roughly $3,350 a month. I wanted to do something that paid me based on my results, not a locked-in salary. I had no problem with the idea of working 80 hours or more per week, but I wanted to be paid based on my productivity. So despite what I always said as a youngster, I followed the footsteps of my grandfather, father, aunts, and uncles into the automobile industry.

KEATING’S PATH TO BUSINESS SUCCESS

Kathleen accepted a job as a manufacturing supervisor for Dell Computer Corporation in Austin, and I interviewed for a sales job at Austin’s Covert Ford.

Knowing that most “dealers kids” would not make a great employee, I decided I wouldn’t say anything about my father and the family business on that first interview. I thought the interview went well, but I was not offered a job. I had a beard, and as I was walking out, one of the old salesmen pulled me aside and said, “I’m going to give you a tip. These guys are super conservative. If you want a job here, you are never going to get one with a beard. They believe facial hair doesn’t work with our customers.”

I had decided Covert Ford was where I wanted to work, so I went home and shaved. I had a beard for quite some time, and it took about two weeks for some color to return to my face. Once it did, I returned to Covert with a clean-shaven face. I told them all about my history being a car dealer’s kid, from working as a porter to earning an engineering degree at Texas A&M and so forth. I still wasn’t offered a job. The first time it was because of facial hair, the second time it was because I was a dealer’s kid. I basically decided that I needed to interview somewhere else. I was barking up the wrong tree. I ended up talking to someone at Service Group, which is the insurance company where I done the internship previously. That person made a phone call on my behalf, and the next thing I knew, I was offered a sales job at Covert Ford, in August of 1995.

Before I ever started at Covert, I knew from my time working as a porter at Tomball Ford, the top salespeople typically sold 15 cars a month. The overall size of the operation at Covert Ford was much larger than what I grew up in, and this was intimidating. Covert Ford only posted the results of the top 10 salespeople in the Sales Managers office, and they all selling more than 20 cars a month. I knew I had to achieve big results to be successful at Covert Ford.

Within that first month of selling cars, however, I knew I had made the right decision. Covert Ford had 45 salespeople at the time, and I didn’t know what it was going to take for me to be successful. I committed to working from the time we opened (8 a.m.) to the time we closed (9 p.m.) six days a week for the first month.

The other commitment I made was to never walk away from an opportunity. That was a big difference maker. After you have been at the dealership for 14 hours and you are walking to your car at 10 at night, most everybody would see that customer on the lot, but act like they didn’t see him. For that first month, however, I committed to meet every potential customer—even if it was at 10 p.m.—and never walk away from an opportunity. I didn’t, and it paid off. I sold 26 cars that first month and earned $11,400! I hit numerous bonus levels and was the salesman of the month. It didn’t hurt that the top three guys, who were always in the running for salesman of the month, each took a week of vacation during August.

In that first month, I fell in love with my role as a salesman. When Kathleen went to work for Dell, the company was working two long shifts with overtime coming early instead of late. She was going to work around 3 or 4 a.m. and would get off at around 2 p.m. Meanwhile, I was getting home around 10:30 or 11 at night when she was already in bed. We slept in the same bed and lived in the same house, but we basically only saw each other on Sundays.

I thought I was doing really well, and that I had learned everything I needed to know about selling cars, and I was eager to move up. The real fact is that I thought way too highly of myself. I was the salesperson who had been successful early on, and I believed I should be shooting up the ranks. After I had been at Covert for six months, the leadership team began interviewing numerous salespeople for the opportunity to move into the finance department at Covert Ford. I was not asked to interview for this opportunity, which was something I felt like I deserved after selling cars for six months. This is so ridiculous to me now that I have been through this so many times with other young employees, like I was. I had no business interviewing for the finance department after just six months, but like I said previously, I thought really highly of myself. I also realized there were many very talented people at Covert Ford and that I might not get the opportunity to move up any time soon.

I had a close relationship with my father at that point. Other than my wife, he was my best friend, and I knew he was not happy with his used car manager. The only reason he had not replaced the used car manager is because he didn’t have a good candidate. With a view toward a bigger opportunity, I asked my dad for the used car manager job at Tomball Ford. He thought that was a great idea. My mom, Carolyn, said absolutely not. She protested because she believed I wouldn’t get the respect of the other managers because I was the dealer’s son.

Despite the fact she didn’t like the idea, my father hired me and I agreed to become a salesperson at Tomball Ford. I knew my dad well enough to know he wasn’t a patient person. I was supposed to start March 1, 1996. But on February 18, 1996, my dad called and said he needed me here as the used car manager tomorrow. I was right, he was not patient, and he was eager to send his used car manager packing. In February of 1996, I began as the used car manager at Tomball Ford. I loved it, and I was quite successful. I worked plenty of hours, and I was doing everything: trading for cars, reconditioning cars, buying cars at auctions, wholesaling cars, pricing them, marketing them, merchandising them, hiring salespeople and so forth. That’s also the time when I began recruiting at A&M. I’m a believer that if the car business is a fit for you, then there is not a better opportunity for a recent college graduate to make seriously good money. I was so happy with my decision to go into auto sales, and realized that nothing like this was being offered to graduating students at A&M. I made a commitment to recruit

A&M students, something we have been doing ever since. I first hired Aggies who were May graduates in 1996. I am also a believer that first impressions are not always the correct measure of a great fit for this business. We rely heavily on the Omnia profile, which is an independently validated behavioral assessment that takes about 15 minutes to complete. This has been our best tool for determining whether or not someone has the personality traits to be successful in this business, especially since the test can be applied specifically to retail automotive. We are an extremely Aggie centric organization. We have hired well over 50 Aggie graduates, and this has been a large part of our success. Our people are the big differentiators for our companies, and Aggieland has the best the world can offer.

I worked at Tomball Ford for about five years. I ended up recruiting, hiring and training most of the managers over that five-year period. My dad gave me the opportunity to buy into the business up to 5% per year, and every dollar I could save went into buying stock.

These were great years. Kathleen could now afford to stay at home to raise our family with the birth of our son, Carter, in 1998, and our daughter, Katherine (Kate), in 2000. We were settling in, buying our first home and making plans to be in Tomball forever. One of my dad’s great joys outside the car business was construction, and he loved to play in the dirt. He loved to be on a tractor, a backhoe, or bulldozer, and he made the decision he was going to build a new location for Tomball Ford. Building the new location was his primary focus for about three years. During that time, I became more of a leader in the day-to-day operations of the dealership, doing it my own way without much oversight or involvement from him. Once we moved to a new location after the construction was done, however, he returned to the business and became intimately involved in the day to day operations. This is when we started to have some power struggles.

On September 11, 2001, terrorists from al-Qaeda hijacked four commercial airplanes, deliberately crashing two of the planes into the World Trade Center towers in New York City and a third plane into the Pentagon in Arlington, Virginia. My father, who was always a “doomsday prepper,” went into ultra-conservative mode as he began preparing for World War 3. Everyone in the family, including my two younger sisters, Laura and Beth, were given a laminated map with directions to the family farm in Fredericksburg where my father had stored several years’ worth of food and diesel fuel.

Following the September 11 attacks, businesses across the country felt the blow. Stock markets immediately nosedived, and almost every sector of the economy was damaged economically. Meanwhile, the U.S. economy was already suffering through a moderate recession following the dotcom bubble, and the terrorist attacks added further injury to the struggling business community. In response to 9/11, Ford and General Motors introduced a “0 percent interest for 60 months offer” for the first time. Previously, 7 or 8 percent had been a good interest rate on a used car, while 5 percent was great on a new car. So, the 0 percent for 60 months deal was remarkable within the industry.

As a result, we were selling new vehicles faster than I have ever seen. I was having a blast, and we were selling a ton of cars and trading for plenty of cars. I was pressing the pedal to the metal, while my father still wanted to pull back on the reigns. We had a great October in sales, but my father was concerned about the over-supply of used vehicles. I felt like he was asking me to do unreasonable things in response to his concern, and on November 3, 2001, things came to a head when my father fired me. Worse than that, he told me that he didn’t care what I did with my stock, because he was not buying it back. Everything I had saved had gone into buying stock, which meant I didn’t have any savings. My father started paying out all the net income of the business to himself as payroll, but I still had a tax liability for my portion of the business and there was no distributions to pay the taxes. It was a terrible situation where I felt like I was getting squeezed into financial submission.

Fortunately, I still had the incredible support of my wife and our friends. This was a very difficult time for my family, but also a time that allowed us to develop and grow our faith, something that came out of our involvement at Northwest Bible Church. The relationships with pastors Bob and Ann Livesay, our church friends, and the small groups that we were involved with, were bright spots during this dark time. The dispute with my dad over the investment I had in the stock was ugly, and had gotten to the point where attorneys were involved. This time of unemployment also made me realize how much I wanted my own dealership and my own financial security. However, our children were extremely young, and I didn’t have a source of income. Our son, Carter, was now almost 3 and our daughter, Kate, was 1 at the time. I felt the serious weight of needing to provide for my family. Kathleen and I had just moved into a new house with a $1,200 monthly mortgage. I only had $700 in the bank, and I was unemployed. I called a good friend, Joe Mallette, who was a wholesaler, and he gave me an auction buyer card on his license. I went to the auction and bought two cars. I took them to some of my dealer friends and sold them, earning $500 from the auction, so I could make my mortgage payment. I could survive for the month of November, but Christmas was coming, and I needed to do something quickly.

KEATING’S MOST DIFFICULT CHALLENGES

My father fired me on a Saturday morning, and I had not had a Saturday off in many years, as Saturdays were typically the big selling days in the car business.

With no place to go and nothing better to do, I drove around all day. I was a lost puppy dog. Ironically, my wife and I remember this difficult time and the ensuing months as being some of the best times in our marriage, aside from our family situation with my father. I wanted to settle with my dad on a reasonable value for my stock at Tomball Ford, but he wasn’t budging. It was a stressful time, but Kathleen and I grew incredibly close, and we spent some amazing time with our kids.

Over the ensuing three months, I learned about the possibility of purchasing a Ford dealership and a Dodge, Chrysler and Jeep dealership in Columbus. A small community of about 3,700 people located 74 miles west of Houston on Interstate-10. I reached out to my longtime friend, Don Whitaker, who was originally from Tomball and also went to Texas A&M at the same time as Kathleen and me. Don’s wife, Allison, was my sister’s best friend in grade school. I first met Don when I was in the fourth grade and my sister was having her second-grade birthday party out at our home. One of the party activities was a boys against girls scavenger hunt. Don and I whipped those girls in that scavenger hunt. Don and Allison started dating each other in high school, and I lost touch with them when I moved to Oklahoma in high school.

Don was a finance major, and Allison was an accounting major. Following their graduation from A&M, Don worked at Arthur Andersen in Houston, and Allison was getting her masters at A&M, so they still lived in Tomball. When Kathleen and I moved to Tomball in 1996, we became really good friends with the Whitakers and we’d often get together for dinner. Don was a consultant specializing in financial modeling at the time, and for the last several years of his time at Arthur Andersen, he had one client and one project. It was his job to determine the financial feasibility of bringing the NFL back to Houston after the Oilers left for Tennessee. He did all of the financial modeling for Bob McNair that resulted in the founding of the Houston Texans in October 1999. Following that, he left Arthur Andersen to start his own company doing financial valuation.

One evening at dinner with the Whitakers in Houston, I was talking to Don about the possibility of purchasing the dealerships in Columbus. I had been looking at the financial statements, estimating about how much I would need to make each month to turn a profit. When I told Don some of the details, he started peppering me with questions. “I don’t care what your income statement is, all I care about is your cash flow,” he said. “You can make money and still go backward on cash, and that is what could cause you to go broke. Let me come to the house. I can bring my computer. I have the spreadsheet I built for the Texans deal, and I can ask you about 30 questions. I will enter your answers, and then we can print out the cash flow statements, depreciation statements and so forth.” We met and continued to go back and forth evaluating the Columbus dealerships.

Ultimately, I negotiated the purchase, believing it was a good opportunity, if I could borrow the up-front money. I thought it was a small enough opportunity that I was going to be able to afford it, but large enough that I was going to be financially successful in it. I eventually met with the owners of the dealership in Columbus at the Cracker Barrel in Katy and asked them to commit to signing a letter of intent (LOI). A letter of intent is a document outlining general plans of an agreement between two or more parties before a legal agreement is finalized. An LOI is not a contract and cannot be legally enforced, but it signifies a serious commitment from one involved party to another. I didn’t have any idea how I was going to structure the deal financially, but I wanted them to commit to it by signing the LOI. They chose not to sign the LOI, but told me we had a handshake agreement. They instructed me to finalize the legal documents and we could make the deal happen.

On the way home from that meeting at Cracker Barrel in Katy, Mike Franklin, who owned a Dodge, Chrysler and Jeep dealership in Port Lavaca, called and said that Ford dealership in Port Lavaca had just gone broke. The police were actually in the showroom holding all the titles and the keys. “You need to get down here and check it out,” Mike said. At the time, I couldn’t have even told you where Port Lavaca was located (27 miles southeast of Victoria). When I visited Port Lavaca, though, it looked like an equal opportunity to the dealership in Columbus. It was a unique situation, because Ford Motor Company wanted to shut down the Port Lavaca dealership because two different dealers had gone broke in a span of seven years. But Ford Credit, on the other hand, did not want to shut it down because Ford Credit was owed a significant amount of money from the dealership. Ford Credit wanted its money back. Working in my favor, I knew I had a great relationship with Ford Credit from when I was in Houston, and I believed these key contacts would help me in purchasing the dealership. So because it was a much cheaper investment and I had a higher chance of getting Ford Credit approval, I went to work on putting a deal together to buy Port Lavaca Ford.

Don Whitaker and I once again formed an alliance as we evaluated Port Lavaca Ford. Meanwhile, I was also sharing details of my plan and asking for advice from two other people. I didn’t know it at the time, but one of the guys I was communicating with was my competitor on the purchase in Port Lavaca, he was also trying to buy it. The way I ended up structuring the negotiation came from what I learned during the sales training in my summer internship at Service Group between my junior and senior year at A&M. I treated it like a car deal. I did it the right way and I structured it the right way. The seller chose to sell the dealership to me, and I am convinced that God blessed me because I was doing things the right away as opposed to my competitor who was essentially trying to sabotage me. In the meantime, I was able to convince Ford Credit to break some of its lending rules to loan me the money I needed. Ford Credit wanted their money out of Port Lavaca Ford badly enough to give me a shot to pay them off.

Throughout the time that passed following being fired by my father, my grandfather was actively involved in trying to heal the rift between my dad and me.

He was squarely on my dad’s side of these discussions, and my father and I were not speaking to one another. I was, however, talking to my grandfather, and he would regularly tell me I needed to fix this. In my mind, there was no point in trying because I knew my father wouldn’t budge. I put the Port Lavaca deal together, writing the agreement on a yellow legal pad. I was so proud of the deal, and decided to call my grandfather to ask for financial help. My grandfather loaned me $340,000. I placed most of the value on the real estate, so I wouldn’t have to come up with much equity. I structured the whole deal where I could buy the dealership with as little cash as possible.

I then had to prove to Ford that it was unencumbered funds. From Ford’s standpoint, the money could not be borrowed money. So, I took the $340,000 to Crosby State Bank and opened a certificate of deposit (CD) on Monday. On Tuesday, I returned to Crosby State Bank and informed the bank officer that I needed to cancel my CD. I was told that I would have to pay penalties, which I said I understand. I closed it down and received the paperwork I needed. I showed that cancellation paperwork to Ford and said that I had all the money sitting in a CD for an opportunity just like this one in Port Lavaca. I simply left out the fact that all the money was sitting in a CD for only one day. I borrowed $340,000, and I needed $320,000 to do the deal. My family was also living off of this money. I don’t believe the penalties were all that much, but I had to do it in order to prove where I had the money saved up.

Once I had finalized and structured the deal, we went to the closing table with both sides ready to sign the contract. We were interrupted before any signatures, however, by a phone call from a representative from Ford Credit. “I don’t know what you are trying to pull, but this doesn’t fit any of our guidelines,” the representative said. “There is no way we are going to approve this deal.” At that point, the deal looked dead. The previous owner of the dealership had been double floor planning cars. In case you are unfamiliar with the term, floor planning is a type of inventory financing for large ticket retail items. Specialty lenders, traditional banks and finance arms of manufacturers provide the short-term loans to retailers to purchase vehicle inventory and they are then repaid as the units are sold. But the previous owner had been double floor planning, so on the same piece of inventory he was taking a loan from Ford Credit and a loan from the local bank.

When he went out of trust, there was a big money grab regarding who would be paid back after the completion of the deal. I had to convince the local bank to take a big loss and to release their liens on all the assets I was trying to purchase.

The representative from Ford Credit was adamant about not approving the deal. Before the deal was completely dead, however, I asked the representative if I could speak to a manager or supervisor. I figured it couldn’t hurt to try to appeal to someone in charge. The representative gave me a number, and I called the Ford Credit headquarters in Dearborn, Michigan. I was transferred from one person to another before eventually being transferred to Jim Gauthier, who had been Ford Credit’s assistant branch manager in Houston, someone I had contacted regularly when I was the used car manager at Tomball Ford. Jim was now the big decision-maker in Dearborn. He said, “Ben I had no idea this was you. Sure we will approve the deal.”

Once the deal was done, it was time to get to work, and I knew I needed to get the right people in place. It’s always about finding the right people. After helping me construct the deal for Port Lavaca Ford, Don told me he really enjoyed the process and working with me. “If you would have a spot for me available, I would love to come and work with you.” I was honored and excited about what we could build together, and we both started the process of transitioning our families from Houston to the Texas gulf coast, or the “Redneck Riviera” as I like to call it. In fact, Don and I lived together in a duplex for about six months when we first went to Port Lavaca, and this was as crazy of an experience as anything else we had done.

In the previous five years, I had hired and trained almost everybody at Tomball Ford in the sales side of the business, and I ended up recruiting many of them to come with me to Port Lavaca. I had learned the car business in Houston, where there were 26 Ford dealers. And since Tomball was a long way away from the big city, I had to convince customers to drive all the way out to Tomball and I had to learn how to compete with the big volume Ford stores. We had gotten really good at it, and I resolved to operate our dealership in Port Lavaca as if we were in one of the most competitive car markets in the world.

In our first full month of business, we sold out of new Fords. We sold 90 new Fords while being located in a town of 10,000 people. We were categorized as a “select dealer,” which meant we were a rural dealer in a small marketplace. Ford would allow us to order anything we wanted, but if we hung ourselves with too much inventory, it was our problem. We ordered a ton of cars, and we sold a ton of cars. We became the No. 1 volume select dealer in the nation out of tiny Port Lavaca. We were rocking and rolling.

At that point, I decided that with my wife and my kids and our standard of living, I needed to make close to $15,000 a month to be stable and to be on a firm financial foundation. In the first month, I made $18,000, which is all that mattered to me. It was still ugly with my dad during this period of time, but I eventually convinced myself that I wasn’t going to worry about it. I was going to be able to make at least $15,000 a month with this deal, and I was going to be able to take care of my family. I called my mom and told her that I was willing to sell my stock. I owned 33 percent of the real-estate and 25 percent of the dealership. “I will sell everything for whatever you will give me for it,” I told my mother. “I don’t trust what dad will do, but the stock isn’t worth all the damage it is doing to our family relationships.”

Even though I thought the full retail value of everything was around $10 million, the situation with my parents had gotten so ugly that Kathleen and I halfway expected receive $1.00. In the end, gave us $1 million for our interest in everything related to the business, real estate and related companies. I took the first $340,000 and paid back my grandfather. That left me with $660,000. A few days later, Mike Franklin, the owner of the Dodge, Chrysler and Jeep dealership across the street from my dealership, called and said he wanted me to buy him out.

“Mike I have only been here a month I am still trying to figure out which way is up,” I told him. “I am just trying to keep my head above water.”

Mike loved racehorses, and said, “I’m moving closer to faster horses and faster women. If you don’t buy me out, you’re going to have a new neighbor.” So after only owning Port Lavaca Ford for 45 days, I met him at the McDonald’s in Port Lavaca and we worked out a deal. On July 3, 2002, I officially purchased Port Lavaca Dodge Chrysler Jeep. Soon thereafter, I hired another group of employees from Tomball Ford, which probably drove a bigger wedge between my father and me. I took about 10 people from Tomball Ford in total, which meant we had an unbelievably talented team who were trained in hyper-competitive Houston, so we were set up for great success in Port Lavaca.

These coworkers came with me from Tomball knowing they were going to make less money, but it wasn’t about the money, it was about relationships. It was about the dream of doing something big with people you enjoy. I received a lot of credit for providing the vision and leadership, but clearly, the only way we were able to grow and succeed was because we had an amazing group of people who knew the formula of running our stores. Once I had everyone in place, I would say that 70 percent of our business was coming from over 30 miles away. We were beating all the dealers in Corpus Christi and in Victoria. We were selling lots of cars and having lots of fun.

Our success frustrated the Chevrolet, Buick and GMC dealership’s owner in Port Lavaca. Eventually, I had the opportunity to buy him out as well. Once again, Don and I put together a plan and scraped together as much money as we could to buy the Chevrolet, Buick and GMC dealership. We still laugh today about how cash poor we were at the time, but it was the building of a larger business structure that was so exciting. We talked then about duplicating the model repeatedly, and it was happening. With three dealerships in Port Lavaca, we enjoyed an economy of scale in advertising and other areas, and compared to Houston, Victoria advertising was dirt cheap. We were advertising so much I became a little bit of a celebrity on television, or maybe a little annoying. But most significantly, I was learning a lot about effective advertising in varying markets. I started using the phrase “BOOMING Port Lavaca” in all of our ads, which was very effective. It was partly wishful thinking, partly my perspective on our business, and partly a “Field of Dreams” idea of “if you build it, they will come.”

Perhaps most significantly at that time, I had somewhat of a healing scenario with my dad in the fall of 2003. For the first time in a long time, the Keating family—the whole family, me and my dad included,—enjoyed a really good Thanksgiving. Then on December 12, 2003—four days following his 59th birthday—my dad took his own life. It is difficult to describe the experience unless you’ve gone through it, but this was an extremely difficult time. I couldn’t help but wonder if I had anything to do with this situation. Logically, I knew I didn’t, but emotionally, you still questions it. We were so close to each other, and then so aggressively at odds with each other, and then at peace with each other.

The emotional roller coaster was crazy. I was angry at my dad for taking his own life. It seemed like the most selfish thing a person could ever do. I enjoyed my dad immensely, and he was gone in a quick moment without the chance to do anything about it.

There were plenty of factors that contributed to his suicide. The way our family attorney described it, our dad had a squirrel cage in his head he couldn’t turn off.

We believe he was bipolar, which explained his huge mood swings. He had recovered from cancer twice in the 1980s, but a cancer scare had returned in 2003.

He had just started taking an anti-depressant a few days before, and somehow he just lost touch with reality. While it was an incredible shock and personally devastating, it created the situation where our family became closer than ever as we all dealt with the shock, and it also created a lot of difficult business issues.

My father had created rules in case anything ever happened to him, and everyone in the family knew them well. First, he didn’t want my mom to run the dealership.

Second, he didn’t want her to sell it to a family member. And third, he didn’t want her to carry a note on the sale of the business, and he instead instructed her to sell it for cash.

In the aftermath of my father’s suicide, I spent plenty of time at Tomball Ford helping to manage the dealership. Ford allowed plenty of time to pass before representatives eventually came to my mom and wanted to meet about the future of the dealership. She asked me to represent her and to accompany her at this meeting where we all received a big surprise. One of the Ford representatives said, “Carole you can operate the store if you want to, but we hope you don’t. You can sell the dealership. It is worth a lot of money, and we can help you find a buyer. You can sell it to somebody else, but we hope you don’t. We want you to sell it to Ben.”

Then the representative turned to me and said Ford wanted me to sell everything in Port Lavaca and take over Tomball Ford. My mother and I left the meeting and tried to process what had just taken place.

Once the dust settled, I made a deal with my mom. She was concerned about taking care of the employees who had been with the dealership a long time. I suggested that if I could convince Brent Christiansen to come back to the dealership, then Steve Boone, Brent, and I would purchase it from her. Brent had worked for Ford in the mid-90s, and I had convinced him to leave Ford and come to work in Tomball as the General Sales Manager almost 10 years prior. Steve was the controller at Tomball Ford who had been my mom’s main point of contact. At the time of my father’s death, Brent was working for Gulf States Toyota. I convinced Brent to come back Tomball and to partner with Steve Boone and me in our purchase of the dealership. This opportunity gave all three of us a chance we wouldn’t have gotten any other way. My mother put together the deal and used an interesting formula. The deal was structured so that Brent, Steve and I were not allowed to take anything out of the dealership until she was paid off. In September of 2004, we bought the dealership and my mother carried the note. She essentially broke all my father’s rules. I didn’t have any money at the time because I had just bought the three stores in Port Lavaca, and we were super tight on cash. Against Ford’s wishes, I did not sell the Port Lavaca stores. The purchase of Tomball Ford was a 100 percent stock purchase, I didn’t have to put any money down, it was a 100 percent loan.

I had become somewhat of an advertising expert while I was in Port Lavaca because advertising was so cheap, and I could try different things for different stores to see what generated results. It was my own little advertising laboratory. In March of 2006—March is always Ford’s big truck month—we went really big and took some huge risks. We made some outrageous offers and I sent out 350,000 mail pieces. I took everything I had learned in Port Lavaca and applied it to everything we were doing in Tomball. In March of 2006, we were the No. 1 volume Ford dealer in Houston. We were also the No. 1 F-series dealer in the nation. We received plenty of recognition, and we attracted the attention of other auto manufacturers. Representatives from Dodge, Chrysler and Jeep came to Tomball Ford and asked us if we would consider buying one of their dealerships in Houston. “The only one I would be interested in is the one across the street,” I said.

They said the asking price was ridiculously high, but that did not scare or intimidate me, even though I still didn’t have the money to buy it.

My mom was really enjoying the success at Tomball Ford, and she was involved in all of the celebration and growth. She was having a ball being more involved in the business for the first time. When I told her about the representatives from Dodge, Chrysler and Jeep and the store across the street, she agreed to finance the purchase of the Dodge store. We bought the Dodge store and were extremely successful extremely quickly, but I was still 100 percent leveraged.

I am extremely grateful to my mom for taking the risk on me. I recognize that our history through drug treatment and the tumultuous time with my dad had to make this decision very difficult for her. I would have never had the opportunity to purchase these large Houston dealerships without her willingness to take the risk on me. These stores provided a much broader foundation for us to become a small “auto group”, instead of just being the dealer in Port Lavaca. Additionally, I am grateful for my father and all the things I learned about running a business from him, even though I didn’t realize what I was learning at the time. He was ultra conservative, and I am not. Therefore, he was a good ying to my yang, and this has helped me in my career. I am also grateful for my grandfather and aunts/uncles who were in the car business, because I know I learned through osmosis of being around them during holidays.

This time just after the purchase of Tomball Dodge was interesting, because we had such quick and extreme growth. In our third month at Tomball Dodge, we were the No. 3 volume Dodge dealer in the nation. Shortly after our big success at Tomball Dodge, the market representation managers from Chrysler kept trying to convince me to buy dealerships all over Texas. I was already in over my head, but I couldn’t pass up the opportunity to buy the Chrysler, Dodge and Jeep store in Boerne in August 2008 and also the Chrysler Jeep dealership in Tomball. I combined the Tomball brands to create Tomball Dodge, Chrysler and Jeep.

Additionally, I started looking at a few other opportunities within the brand I might be able to afford soon, and started to focus on Grapevine, Texas.

This was in 2008, and on September 29, 2008, the Dow Jones Industrial Average fell by 777.68 points, which up to that point was the largest point drop in history. It was the most serious financial crisis since the Great Depression in 1929. Predatory lending targeting low-income homebuyers, excessive risk-taking by global financial institutions and the bursting of the United States housing bubble culminated in a “perfect storm.” Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers and a subsequent international banking crisis.

In the summer of 2009, both General Motors and Chrysler declared bankruptcy. This meant that five of my seven stores were selling cars for a manufacturer that was restructuring. At the time of the financial collapse, I had $18 million worth of loans with Chrysler Financial and GMAC for real estate and capital loans for the purchases of all these businesses. Since Chrysler Financial and GMAC were owned by Chrysler and General Motors, they were not FDIC-insured banks, and didn’t fall within the federal banking rules and regulations. First and foremost, their job is to support the business of the mother ship, and that meant that they could—and often did—loan money much more aggressively than the banks would. I had proven myself as a successful car dealer, so the manufacturers were willing to take risks on us, but back in the midst of the financial collapse, GMAC and Chrysler Financial also went bankrupt. In a risky move, I worked with the people at Chrysler Financial to purchase the assets of Grapevine Dodge Chrysler Jeep out of bankruptcy court and agreed to cover the debt. I added yet another dealership at a time when it could have all amounted to nothing.

Several months later, we were forced to restructure our loans with a much more conservative federally regulated bank. We had mortgages less than 24 months old and we had to come up with more cash due to the drop in asset values. So, I began selling down all of our used cars, borrowing money off of our service contract reserves and piecing together every dollar I could piece together. I came up with $5 million. I was offering to buy down the $18 million in loans with GMAC and Chrysler Financial to make it $13 million. I remember where I was standing in March of 2010 when I received a call from Shawn Allgood with GMAC. I was on spring break vacation with my family, and Shawn said, “Ben, I’m sorry but there is nothing we can do for you. We have looked at your whole deal, we have gone through your whole package. We have structured everything the best way we could structure it. We can’t get you approved.”

I thought my career as an automobile dealer was done. But like I had done in Port Lavaca, I decided to make one more call. I called Shawn back and asked him if it would be different if I could find an additional $1 million. “Ben, we have gone through all of your businesses and you don’t have another $1 million,” Shawn said.

“That’s beside the point,” I told him. “What IF I come up with another $1 million? I don’t care if you put it on floor plan, if you put it in a CD, if you put it on mortgages or capital loans. I don’t care what you do with it. You can just have it in there as reserve for a rainy day, but what if I came up with another million dollars?”

Shawn said he would find out, and he began calling various board members. Eventually, he called me back with an answer. “OK, we can get you approved on two conditions,” he said. “First, you must come up with an additional $1 million. No. 2, you can’t have a single delinquency for the next twelve months. The reason you didn’t get approved is because 90 percent of your payoffs are delinquent. You don’t look like you have any operating capital. You look like you are broke already.”

I thought it was impossible that 90 percent of our payoffs had been delinquent. We devised a fool-proof system so that nothing would be delinquent. I then dug into the system and what I did not know is that Chrysler Financial and General Motors gave us five days from the day we sold a car to pay off the loan. All of our systems were in place to pay them off of the fourth day. Under bankruptcy, these loans had switched to federally regulated banking rules, which changed the payoff deadline to three days and I didn’t know it. All of our systems were in place to pay everything off in four days, but we looked broke because everything was one day late. So, what is interesting about the whole thing is that we were doing enough business that delaying one day of payoffs created the need for an extra $2 million in operating capital. Not only did I have to come up with another $1 million for the down payment to get our loans refinanced, but now I had to move all of our payoffs forward one day, which required another $2 million. But we didn’t have any other choice if we wanted to remain in business. So we started doing our own internal audits every day, chasing down every single car deal, because we could not allow a single delinquency.

We also could no longer afford to have any used cars. The money we pulled together to pay down the extra amount was basically the operating capital we had inside the stores for used car inventory. So, we made the choice to get completely out of the pre-owned business for a while.

We became an audit firm more than a car dealership. We were making sure we did not lose our agreement in those loans. We had never been tighter on money than we were right then. I had literally borrowed money from everywhere I could possibly think of because of this financial situation. We had a minimum payment worked out with my mom on Tomball Ford and Tomball Dodge, and we had to go to my mom and tell her we don’t have enough money to pay the minimum payment for the quarter. She didn’t know what was really going on in the business, and was very defensive. She wanted to be sure she wasn’t going to take a huge loss by taking the risk of breaking dad’s rules. It was a difficult time as we tried to squeeze blood out of the turnip.

In response to all that was happening, I changed my management of the businesses. I spent a lot of time trying to figure out how to hold all of these businesses accountable in a way where I could compare my smallest store (Port Lavaca Ford) to my largest store (Tomball Ford). I became much more efficient, and I started making more money because I was wasting less money.

Meanwhile, the price of oil and gas started going up. The first well within the Eagle Ford Shale near Victoria was drilled in 2008. But it wasn’t until 2010 when drilling permits in the Eagle Ford Shale began to dramatically increase. In 2010, there were more than 1,000 permits issued, and things began to absolutely explode.

It represented a golden opportunity for practically anyone involved in the oil and gas industry, especially those companies and contractors based in Texas. It also represented a great time in automobile sales in the Lone Star State. From 2011-15, our sales were really strong.

Sales were so good that in 2013, we paid my mom off, which was a massive springboard for us. I was free and clear to be able to generate some capital. We bought College Station Ford in 2014. Then, the BMW, Mazda, VW, Hyundai stores from Garlyn Shelton in Bryan the following year of 2015. In 2016, we bought the Nissan and Honda dealerships in Conroe along with the Dodge Chrysler Jeep Ram store in Victoria. We continued to invest our liquid capital into purchasing more stores and had reached 16 stores. This time, though, became a particularly difficult time for me personally. At that point in time, we had a general manager at each individual store, but I was very personally involved in the day-to-day operations and decisions with each GM at each dealership. It was too much.

The big change that happened at that point was that I moved out of my office at Port Lavaca Ford. We created a corporate office in Victoria, which was initially strange because I had always been anti-corporate, but I knew things needed to change. We brought Stephen Livesay, who had been our operating partner and general manager at all three stores in Port Lavaca, into the corporate office as chief operating officer. Don Whitaker also moved out of Port Lavaca and into our new building. Our in-house attorney, Chris Wall, got the opportunity to move out of “the firm,” which was our affectionate name for the portable building we had in the parking lot of Port Lavaca Chevrolet, to join us in the corporate office. Together with the advertising agency and the insurance company we had built up over time, we started a corporate office and got pretty good at sharing the load of leadership. With this new structure in place we were able to grow from 16 stores to 20 stores.

With 20 dealerships, all of us were running ragged once again. We were busier than we wanted to be with all the responsibilities and priorities tugging at us. We all met as a group and made the decision that we did not want to stop growing. We decided the right thing to do was to bring in some additional support. We met with Larry Van Tuyl, who had operated an organization of well over 100 privately held dealerships. Larry was one of the few people in the world who had blazed that trail and had done what we were looking to do. The meeting with Larry really energized us. We wanted to have someone supporting service and parts, someone supporting all e-commerce and someone to help with various other departments.

These moves freed up enough time in the day where we felt comfortable growing again. In a span of two years, we bought 11 more stores in 2020-2021. We also sold two and terminated one to bring us to 28 stores. Under the Keating Auto Group umbrella, we function as entrepreneurs, business owners who collaborate and figure out how to run their business. I just happen to be the majority owner in all of them, but Stephen Livesay and Don Whitaker are providing most of the leadership these days. We do quarterly meetings. We do incredible composite reporting. Everything is wide open in terms of performance and numbers. Everything about the business is open to everybody. If you are doing a poor job, you stick out like a sore thumb. If we added a store in 2010, it was a big deal. It just felt like so much more work. Now it is much easier to add another store. All the processes and reporting procedures are in place.

This success is absolutely not about me, but about the incredible team we have in place. We have proven that we have a model we can repeat over and over again.

Even though the car industry is an incredibly competitive market, we have developed a model that has enabled us to be extremely successful in this environment. Our model for success is set up with the understanding that every Ford dealer has the same F-150 on his lot. Our opportunity to make money is not in selling the F-150, but instead it is everything that happens after the customer says he wants to buy the F-150. It is in the banking, financing, insurance, service, parts, trade-in and so forth. Even though we are selling a product, we are essentially in the services business. We can afford to be extremely competitive on price if we build loyal customers at the same time.

When I mention insurance, I am not referring to full coverage or liability. An example of the insurance I am highlighting involves every time a customer buys a set of tires, the tires come with a road hazard warranty. If the customer runs over something and the tire blows out, we will replace it for free. But what most people don’t realize is that $8 of that tire purchase is insurance. That road hazard warranty is insurance. That type of insurance can be utilized numerous times in the car industry in things like gap insurance, service contracts, extended service contracts, credit life, dent and ding protection, key replacement, windshield, tire wheels and so forth. I had done all the math and figured out that once we reached a certain size, we could afford to become a full, federally regulated insurance company. We currently sell about $50 million a year in insurance. The margins in the business are very small, but it all adds up in the long haul and it provides a valuable service to our customers, because we handle it in-house instead of with some giant corporation.

We also have a management company, run our own advertising agency, and are heavily involved in the GPS industry. We have grown to be large enough that in some ways we have decided we could build a better mouse trap to handle some of the things we were outsourcing.

As of April 2023 when the Automotive News rankings come out for dealer groups in the USA, Keating Auto Group was the 15 th largest dealer group in the USA.

And with the top six groups all being publicly traded companies, we would be the 9 th largest privately held group, and the largest in Texas. The all seems so crazy knowing where we started in 2002.

In February 2024, I was honored by the Texas Auto Dealers Association as the Texas nominee for the Time Dealer of the Year, based on the work we do in our communities and our work with Texas A&M. There is something special about being honored by your peers, competitors, and colleagues.

Again, I want to point out that the success of our businesses is based on our people. I love to get into our quarterly partners’ meeting to see the amazing team of people we have running our stores. The people we have are our greatest assets, and they are what gets me most excited about the future. We have made the choice to try to pour love into as many of our 2200+ families as possible. We do an annual retreat for those who want to attend where we alternate topics between marriage and parenting. We try to build into their lives that they are an integral part of a larger community. For each business, we have devised a model for assembling our teams. We promote from within on all positions when we are able to, as hiring people from the outside is much more challenging. When you come from the inside, you know how we want to do things. As noted earlier, I have been quite successful in hiring Aggie grads. I fully realize no one attends college with aspirations of becoming a car salesperson. However, I believe that is because most people do not realize the opportunity available to them in the car business. It is safe to say that most Aggies we hired made $80,000 or more in their first year in the car business. In fact, many have made $100,000 or more. I can also say that several were making $180,000 or more within their first five years. This is not something easy to find in big corporate America. Yes, the hours of “retail” are long, but they are way less than the tremendous hours my friends put in at the accounting firms or consulting companies. I always appreciated getting paid based on my personal results and efforts. I love working with a team of people in such a fast paced environment. The connections and relationships made in this business are special also. It is so very different from an “office job”, and I think it offers such a great opportunity for those who are a “good fit”.

I am very proud of the way we showed the importance of our people in our response to the COVID-19 pandemic in 2020. We kept everyone employed even though there were no customers coming in the door. We made sure everyone got paid as we figured out how to deal with the challenges. Luckily for our business, Governor Abbott declared auto dealerships as essential businesses and we were allowed to stay open, but it also meant we had to change our business model in quick order. A large portion of our people ended up getting the virus at some point over the next 2 years, but we all worked together to support each other and to be in position to support our communities. I also think this ability to change quickly to adapt to whatever situation life gives us is a gift for an entrepreneur.

We find solutions and bring people together. In the end, we are rewarded for it.

I also want to give some “kudos” to our adopted hometown of Victoria, Texas. The value of raising our kids in Victoria was significant. I am constantly amazed at the adults our kids, Carter and Kate, have grown in to. They are grounded, Godly, kind, and compassionate. I know the kind of trouble I got into, and I feel completely blessed that we haven’t yet had those challenges. Victoria has been a really great place for our family for many reasons. I also don’t really know how it happened that both kids ended up going to Texas A&M, but I am delighted with the fact that we are an Aggie family.

I love the saying that behind ever great man is an even greater woman. This is certainly true in my life. I have been married to Kathleen now for 28 years. There is no way any of this would have been possible without her. We have been at the bottom and we have been at the top, but we have done it all together. Her strong support has allowed me to go out on a limb on occasion and it has been incredible to share life with her. Whether in business, or in family matters, or even in racing cars, Kathleen has been a wise sounding board. We have done it all as a team.

KEATING’S ADVICE TO ASPIRING LEADERS OF THE FUTURE

There are so many directions I could go in this section. I could write at length about the potential hazards of going to work for a family member. I could also write about the value of being independent so soon. You learn many lessons when you are on your own and paying your own bills at an early age. I could also write about the value of simply making one more call, or making one more attempt before giving up on a dream or plan. I’ve already written at length about the magic of finding, hiring, and retaining great people. I should also write about all the hard lessons I learned in 2009 and 2010 about establishing liquidity outside of the business, and the importance of cash in any business.

Instead of any of those topics, however, I would simply encourage you to find a way to be passionate in how you invest your time and energy. The world tends to make way for the person who knows where they are going, and I believe your passion defines your direction. As I have already noted, I didn’t want anything to do with the automobile dealership industry when I arrived at Texas A&M. But I am a highly competitive person, and I quickly discovered that the car business was a perfect industry to stoke my competitive fire. One of the main reasons I was successful when I started was that I was so passionate about it. It consumed me, and I loved it. I also discovered a hobby that I was passionate about in 2006 that has become another major part of my life. It also involves cars, but not selling them.

KEATING’S PASSION FOR RACING

It’s typically been difficult for my family to find Christmas gifts for me, but for Christmas in 2005, Kathleen nailed the perfect gift. She thought it might be fun to buy me a track day at the now-defunct Texas World Speedway in College Station. At the time, visitors could learn about racing and could drive their personal car around the track. I redeemed my $250 Christmas gift in 2006, knowing virtually nothing about racing. I wore shorts and tennis shoes, and I did not take a helmet or tools. I borrowed a Dodge Viper from one of my showrooms, and it was the most fun I’d ever had. I was completely hooked. I started racing in 2007 in the Viper Racing League, which is a club-level, gentlemen’s racing series. In 2008, I won my class and continued to move up to more challenging classes through the years. I often like to say that my personality hasn’t changed much from high school, but my “drug of choice” is now racing cars.

As mentioned, I started out in what would be considered “club racing” in the Viper Race League. In my first six races, I was involved in six different incidents, and I was put on probation. This was exactly what I needed, and I started to progress quickly. In 2010, my grandparents passed away and left me some money. In total “addict” behavior, I chose to spend this money on driving in the Rolex 24 Hours at Daytona. This was where I got completely hooked on endurance sportscar racing.

Fastforward and in June 2022—and in my eighth trip to the 24 Hours of Le Mans—I earned a class win, with a victory in the LM GTE Am class in an Aston Martin. I came extremely close in 2019 by winning the class in my personally-owned Ford GT. But the title was stripped from me due to several minor technical infractions. It was the Ford GT’s last year racing at Le Mans, and the cars were carefully scrutinized post-race. The victory in 2022 was especially rewarding because of the disappointment in 2019. Then in June of 2023, I had the amazing honor of winning Le Mans again, but this time in a C8R Corvette. It was the perfect storm… Back to Back wins, the 100 th Anniversary of Le Mans, an American driver winning with an American team, winning the biggest race in a car that I sell, winning in the last year of the GTE class, and on and on.

As a driver since 2007, I have now won the 24 Hours of Le Mans, the 24 Hours of Daytona, the 12 Hours of Sebring, Petit Le Mans and many other endurance events. I won the North American Endurance Cup in IMSA in 2017, 2018, 2019, and 2021. I won the national championship in the LMP2 class in 2021 in IMSA and was Vice Champion (second) in the World Endurance Championship. Maybe the pinnacle of my racing career is happening right now. In 2022, I won the FIA GT-Am World Championship in the Aston Martin racing for TF Sport. Then in 2023, racing for Corvette Racing, I won the World Championship again, with the largest points lead there has ever been. Back to back World Championships… The only American to have multiple World Championships...

Chosen by the Series to receive the Gentleman of the Year award. Won the IMSA LMP2 Championship again in 2023. And, ALL of this is far beyond my wildest dreams of driving around Texas World Speedway in College Station 16 years ago.

While I love adrenaline and the high-speed intensity of the races, I actually find racing to be relaxing. I call it an “adrenaline flush.” The focus required to perform well behind the steering wheel won’t allow you to think about anything else, and I love the way I feel after a race weekend. I also love the teamwork required for endurance racing. And, of course, I love the competition. The fact I can compete in the same car, at the same tracks and in the same races with the best racing drivers in the world is still quite humbling for me. I imagine it would be like playing basketball with Michael Jordan or stepping to the batter’s box against Nolan Ryan.

I get to compete with the best of the best, and I continue to learn every time I race. Racing is extremely time-consuming. Realistically, it’s probably too time-consuming when you factor in my all my businesses and balancing time with my family. Obviously, I also have an incredible bunch of guys to mind the businesses while I go out and play.

I really believe there is some truth to the old adage “Win on Sunday, sell on Monday.” I was a Viper racer before I was a Viper retailer. I have also become a better salesperson because I can talk about handling characteristics, braking, the differential or any other topic in a way that most people cannot. I would also say that my racing has helped improve my relationships with my partners. It makes me more relaxed. It keeps me from micro-managing them. It gives me some perspective outside of the car business.

I learn something in virtually every race, just as I have continued to learn with every dealership we’ve added to the Keating Auto Group. In every way, shape and form—from my businesses to my hobbies—I am driven to succeed. And I’ll end this chapter with this simple message to remember: No matter what obstacles you encounter in life, you can thrive if you always maintain your competitive drive, and never stop learning. I am a better racer at 51 years old than I was at 48, because I am passionate about learning.

Finally, I would say that my faith has been a big part of being a survivor. I have leaned so heavily on God during the many times that it has seemed like all was lost. It is amazing to me how Kathleen and I look back at these times as some of the happiest memories. This is not an accident.

I will also end with a music quote. Janis Joplin did a great remake of “Me and my Bobby McGee” where she sings, “Freedom is just another word for nothing left to lose.” And it wasn’t until I was in the position of being completely broken and empty that I really understood the freedom of nothing to lose. It is easy to take risks when you have nothing to lose. And freedom has a much broader meaning than I expected in that it is freedom in so many ways. The joy that has come from trusting God during these times has been impactful for me, even in the good times and successes. It was really hard for me to understand “being a car dealer” as a calling, but I can honestly say I believe I am doing exactly what God has planned for me. This is easy for me to see, because there is no way it could have happened any other way.